20 Jan How Free Are You?

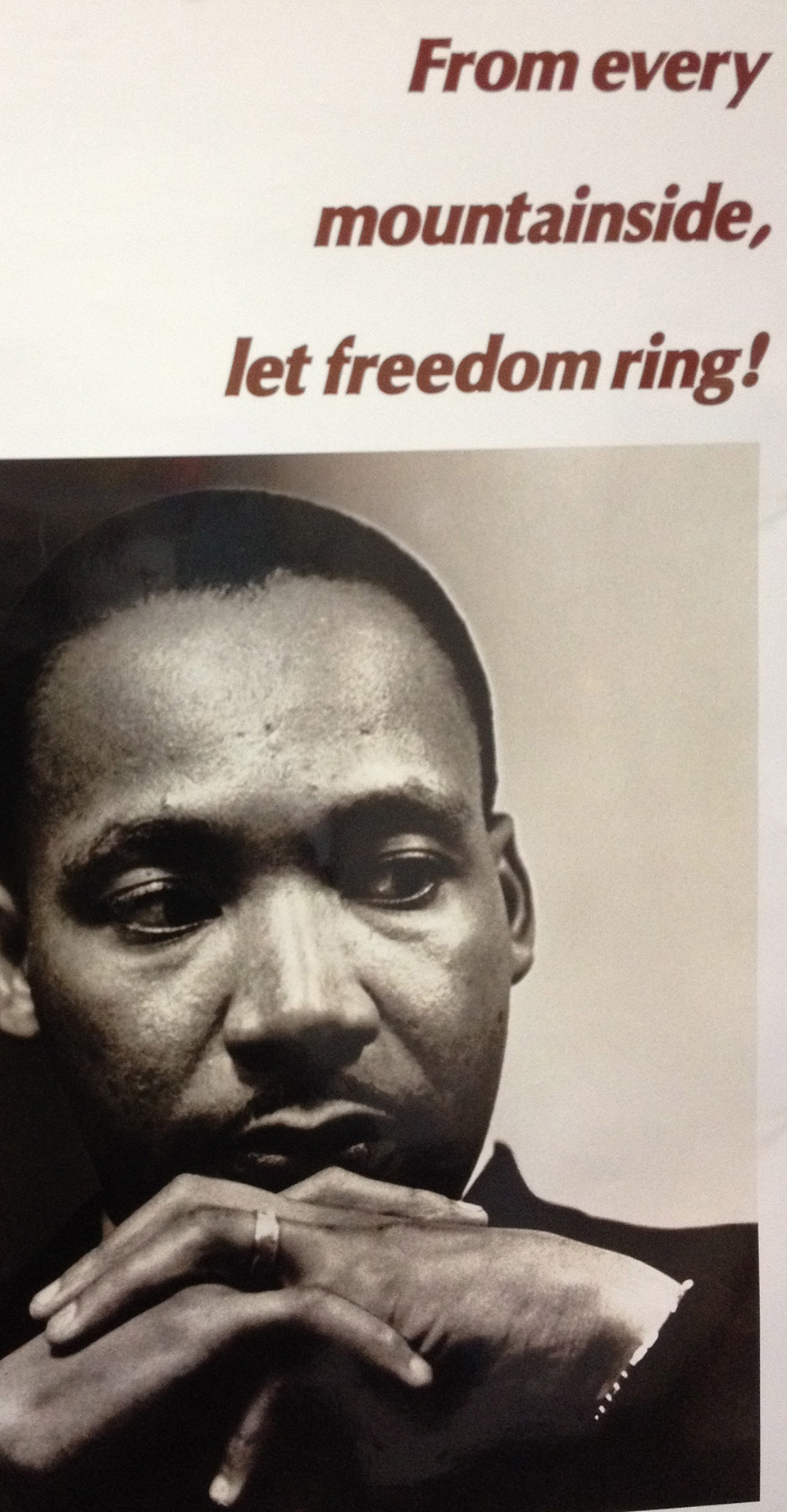

It seems fitting that this blog post will come out on the day we observe Martin Luther King Jr’s birthday. If there was ever a symbol of freedom–it is this great man. Freedom means the difference between breathing deeply and barely being able to breathe.

Martin Luther King, Jr. did everything he could to help others breath deeply. He fought through his own fears, his own suffocating feelings, and took risks to ensure a better life without confinement–for all of us. Confinement = no freedom = stress. When confined, we are unable to express ourselves as desired. We are unable to do what we want. We are unable to live completely, and that is stressful.

My post today discusses another kind of stressful confinement many of us live with: Financial Confinement. We have too much, spend too much, and then suffer because of it–too much. I have asked one of dentistry’s financial authorities to provide three key strategies to help ensure more financial freedom is in our future.

Doug Carlsen is a dentist and writer for Dentaltown Magazine. He focuses on financial advice to dentists and dental providers.

Doug provides the following tips to live a more free life:

1. Have A Family Emergency Fund: This may include the main income producer being unable to work due to illness or injury for an extended period, spouse losing job or being unable to work, or unreimbursed medical or legal expenses for other family members.

How Much, Doug?: Six months of the family budget, not including taxes or savings, normally between $40K and $75K, should be placed aside in a safe account. This needs to be in money market funds as one never knows when it will be needed.

In other words, you need to have a safety net. Accidents happen. Economies change. And the money needs to be readily available in a money market savings account which is considered liquid–easily removed when needed.

2. Have A Personal Liability Umbrella Insurance: About 70% of dentists I work with do not have this coverage. This insurance is necessary when someone gets injured or killed on your property or via a car accident. Your $300K liability coverage will often not cover judgments. $2M in additional coverage added to your homeowners and auto liability costs about $500 per year.

3. Develop A Dentist Illness/Incapacity Coverage Plan with Local Dentists In Your Area: This group has various names. It is a group of local dentists that will come into your practice one-half day per week and see patients for simple procedures and exams to keep your practice alive if you are not able to work for an extended period. This is beyond disability coverage, which won’t help much if you return to a practice without patients. (We have to form this amongst ourselves).

Doug’s great advice can mean the difference between lying awake at night wondering how everything will turn out and resting easy because forethought and foreplanning already occurred. DO NOT WAIT! Plan for the worst–whether you are a dentist, a hygienist, or any working person. Your family needs a plan, some extra cash, and policies in place to be prepared for the unthinkable.

It really does not matter if you make $25,000 or $250,000 annually, your family needs a plan for an emergency situation. Once you have a safety net, then you can buy a few extras.

I remember first opening up my practice. I literally had negative income–so much debt, so much uncertainty, but I did have a lot of insurance policies to cover everything should I croak or become disabled.

For the first year, when I did not know how much I would make or if I would produce the same amount as the previous dentist, I worried incessantly. Once I saved up enough money to cover my family’s 90-day needs, and a little extra to cover any equipment replacement, I felt so relieved. The freedom that came to me via financial security made all of the difference in the world. A broken x-ray unit was not the end of the world. My no-show crown patient did not stress me out (as much).

We have to make sure we save for this type of disaster. I certainly had the option of taking out another loan if needed; that was my double back-up plan. By limiting my spending and not buying every novel piece of equipment on the market, I had my own emergency fund built up within a year and no longer had to rely on the possibility of another loan. And, wow, did I sleep better.

Freedom, no matter what kind–financial freedom, freedom of speech, freedom from discrimination, or freedom to vote for elected leaders– removes the confinements in our lives. Thanks, Dr. Carlsen, for reminding us how to do this better in our dental lives, and thank you, Dr. King, for committing your life to creating less confinement for all of us. Your efforts will not be forgotten.

Link to more of Doug Carlsen’s articles: http://www.golichcarlsen.com/articles/

No Comments